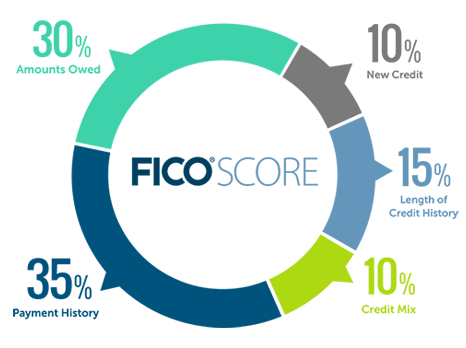

FICO® Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%).

The percentages in the chart reflect how important each of the categories is in determining how your FICO® Scores are calculated. These percentages are based on the importance of the five categories for the general population. The importance of these categories may vary from one person to another-we'll cover that in the next section.

Your FICO® Scores consider both positive and negative information in your credit report. Late payments will lower your FICO Scores, but establishing or re-establishing a good track record of making payments on time will raise your credit score.

Your FICO® Scores are unique, just like you. They are calculated based on the five categories referenced above, but for some people, the importance of these categories can be different. For example, people who have not been using credit long will be factored differently than those with a longer credit history.

In addition, as the information in your credit report changes, so does the evaluation of these factors in determining your FICO® Scores.

Your credit report and FICO® Scores evolve frequently. So, it's not possible to measure the exact impact of a single factor in how your FICO score is calculated without looking at your entire report. Even the levels of importance shown in the FICO Scores chart above are for the general population, and may be different for different credit profiles.

Your credit score is calculated only from the information in your credit report. However, lenders may look at many things when making a credit decision, such as your income, how long you have worked at your present job, and the kind of credit you are requesting.

The first thing any lender wants to know is whether you've paid past credit accounts on time. This helps a lender figure out the amount of risk it will take on when extending credit. This is one of the most important factors in a FICO® Score.

Be sure to keep your accounts in good standing to build a healthy history.

Having credit accounts and owing money on them does not necessarily mean you are a high-risk borrower with a low FICO® Score. However, if you are using a lot of your available credit, this may indicate that you are overextended-and banks can interpret this to mean that you are at a higher risk of defaulting.

In general, a longer credit history will increase your FICO® Scores. However, even people who haven't been using credit long may have high FICO Scores, depending on how the rest of their credit report looks.

Your FICO® Scores take into account:

how long your credit accounts have been established, including the age of your oldest account, the age of your newest account and an average age of all your accounts

how long specific credit accounts have been established

how long it has been since you used certain accounts

FICO® Scores will consider your mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. Don't worry, it's not necessary to have one of each.

Research shows that opening several credit accounts in a short period of time represents a greater risk-especially for people who don't have a long credit history. If you can avoid it, try not to open too many accounts too rapidly.